Tax season can be a stressful time for many individuals, as navigating the complex world of tax laws, deductions, and forms can seem daunting. However, with the right approach and a few useful tips, tax filing can be a straightforward and even manageable process. In this blog, we’ll walk you through the essential steps to make tax filing easy and efficient, ensuring you can maximize your returns and minimize your stress.

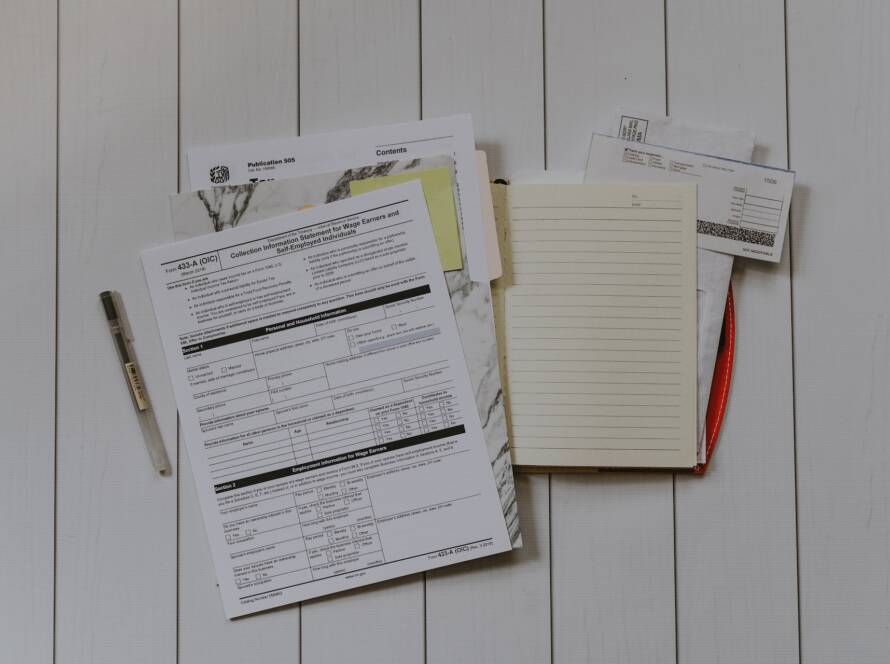

Gather All Necessary Documents

The first step in simplifying your tax filing process is to gather all the necessary documents. This includes your W-2s from your employer, 1099s for any freelance work, receipts for deductible expenses, and any other relevant financial records. Having everything in one place will save you time and ensure you don’t miss out on any potential deductions.

Organize Your Financial Information

Create a systematic organization for your financial information. Utilize folders or digital tools to categorize your income, expenses, and relevant documents. Keeping a clean and well-organized record of your finances throughout the year will significantly reduce the stress of tax filing when the time comes.

Utilize Online Tax Filing Software

Gone are the days of manual tax filing and complicated paperwork. Embrace the convenience of online tax filing software, which guides you step-by-step through the entire process. Popular options like TurboTax, H&R Block, and TaxAct offer user-friendly interfaces, automatic calculations, and built-in error checks to ensure accuracy.

Know Your Deductions and Credits

One of the keys to maximizing your tax refund is understanding the deductions and credits available to you. Familiarize yourself with common deductions, such as charitable contributions, mortgage interest, and student loan interest. Moreover, research tax credits like the Earned Income Tax Credit (EITC) and Child Tax Credit, which can significantly reduce your tax liability.

Stay Updated on Tax Law Changes

Tax laws are subject to change, and it’s crucial to stay informed about any updates that may impact your tax return. Consult reliable sources such as the IRS website or reputable financial news outlets to keep abreast of any changes in tax regulations.

“Tax filing is not just about numbers; it’s a testament to our commitment as responsible citizens, contributing our part to build a better society.”Peter Jackson

Consider Professional Assistance

If your financial situation is complex, seeking the help of a professional tax advisor or accountant can be a wise investment. They can provide personalized advice, ensure that you take advantage of all available deductions, and help you navigate any tricky tax scenarios.

File Early to Avoid Last-Minute Stress

Procrastination can lead to unnecessary stress and even costly penalties for late filing. Make it a habit to file your taxes early, giving yourself ample time to address any issues that may arise. Early filing also means you’ll receive your tax refund sooner, providing financial relief when you need it most.

Tax filing doesn’t have to be a source of anxiety and stress. By being organized, using online tax software, staying informed on tax laws, and considering professional assistance when needed, you can make the process of filing your taxes much easier. Take control of your finances, and with these simple steps, you’ll be well on your way to stress-free tax returns and possibly even a larger refund.